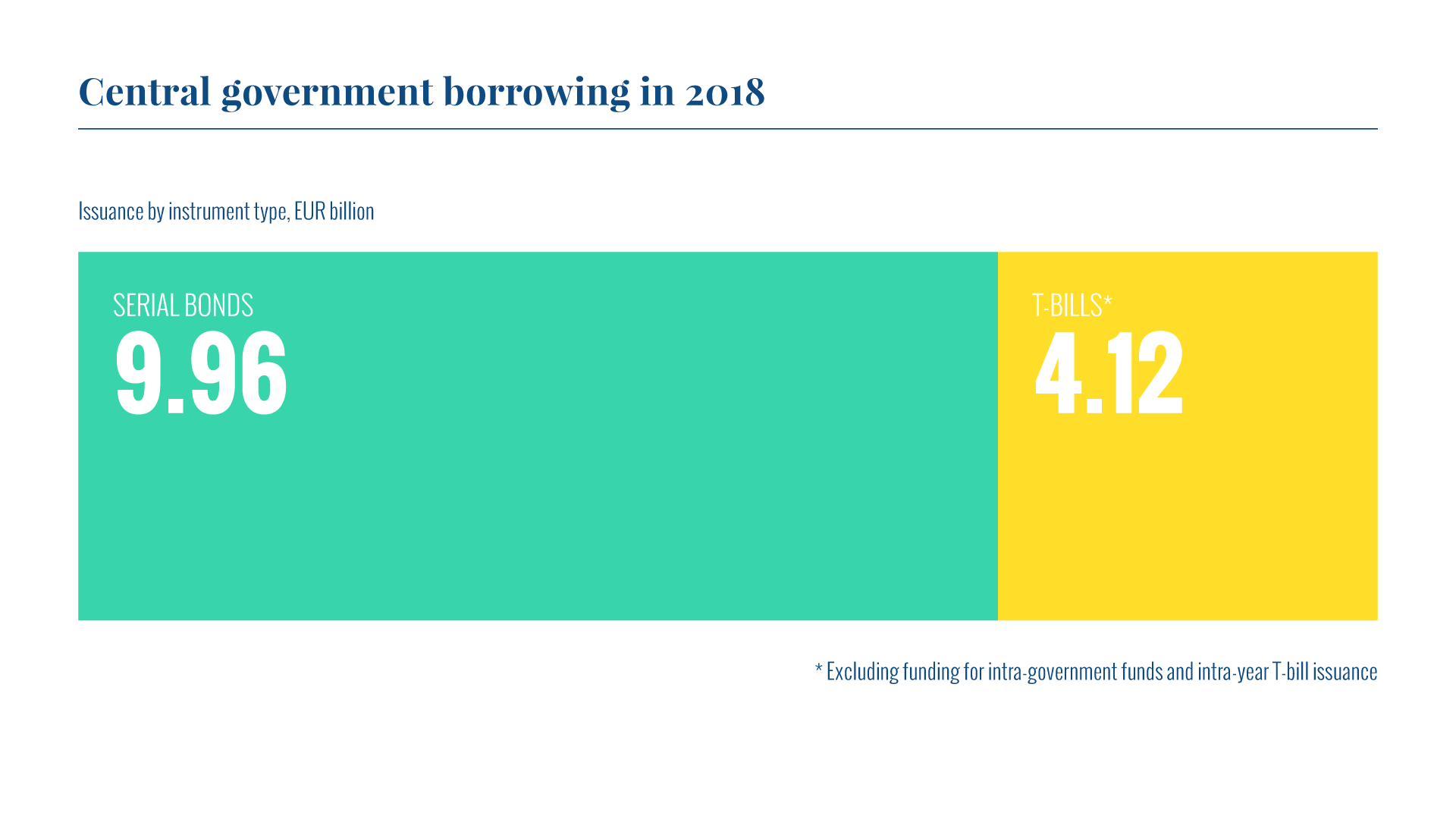

The realised gross borrowing amount in 2018 was EUR 14.1 billion. Of this amount, long-term issuance accounted for EUR 10 billion and the rest of the total was short-term borrowing. The gross borrowing requirement for the coming years is estimated to remain around EUR 15–20 billion annually.

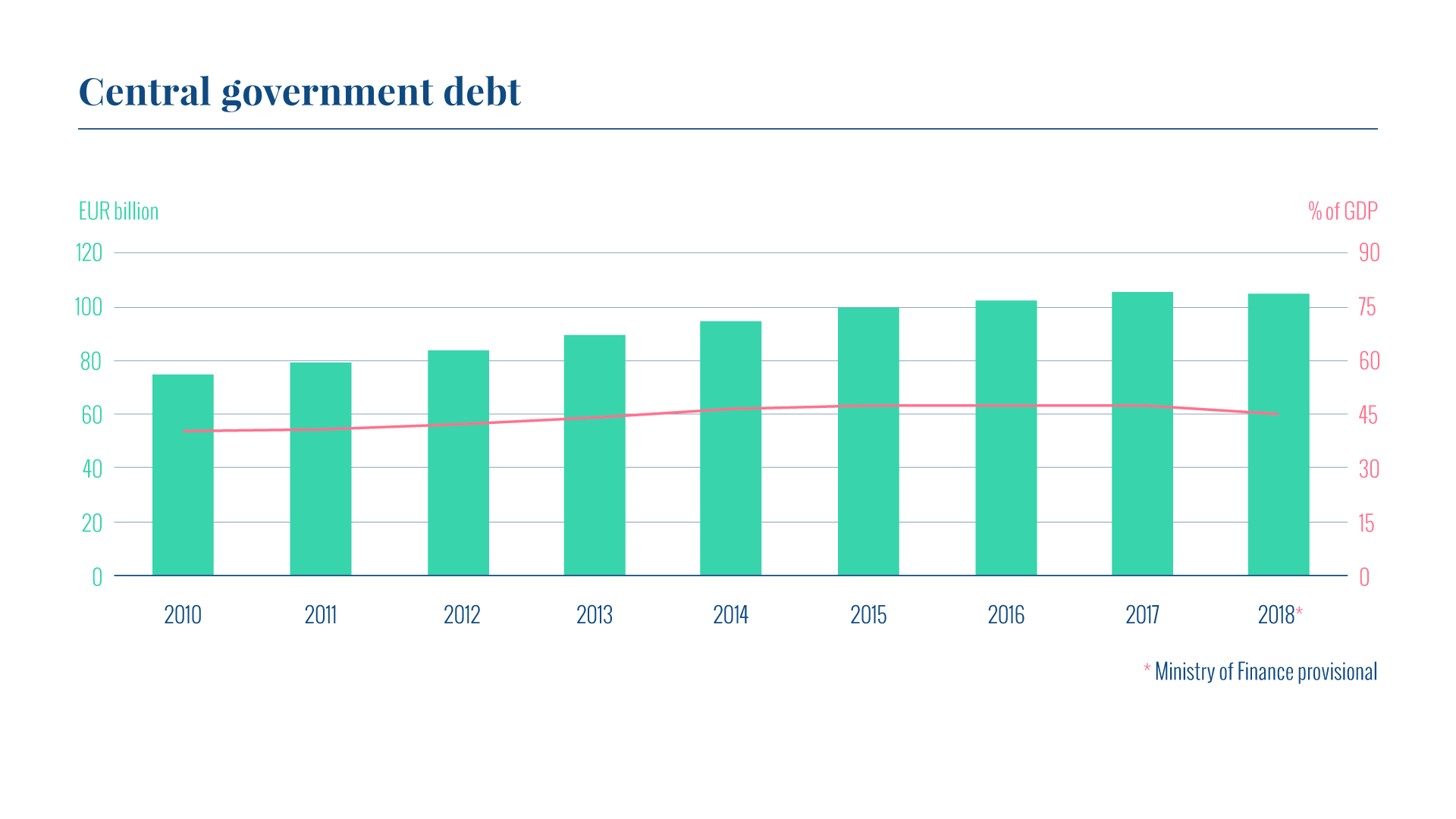

The budgeted gross borrowing in 2018 was EUR 16.3 billion, which included EUR 1.3 billion of net borrowing. However, due to reduced funding needs, the gross borrowing of EUR 14.1 billion was sufficient to cover expenditure on a cash-flow basis and safeguard sufficient liquidity. Since 2011 realised borrowing has been lower than budgeted as net borrowing has been lower than the budget deficit would have required. This is due to e.g. adjustments in income, expenditure and cash buffers and transfers of allowances. These differences are then accounted for in the government financial statements. Due to redemptions of EUR 15.0 billion, the net borrowing amounted to EUR -0.9 billion. As a result, the central government debt stock was EUR 105.0 at year end, i.e. EUR 0.8 billion lower than at year end 2017.

The government’s budget proposal for the year 2019 is EUR 1.7 billion in terms of the net borrowing requirement. With redemptions at EUR 13.4 billion, the total borrowing requirement sums up to EUR 15.1 billion for the year. The intention is to continue the current funding strategy by issuing new euro benchmarks in 5- and 10-year maturities as longer-dated issuance was conducted in 2017 and 2018.

Funding strategy

The funding strategy of the Republic of Finland is based on euro benchmark bond issuance. New benchmark bonds are issued in syndicated form. Syndications are complemented with bond tap auctions, which enable adding to the outstanding volumes of the existing bond lines. There is also a foreign currency bond issue programme, called the Euro Medium Term Note programme. The current funding volume supports two new euro benchmark bond syndications per year, 2–4 auctions, and one benchmark-sized USD bond issue. The short-term funding is carried out by issuing Treasury bills.

In terms of maturities, the focus is on issuing current coupon bonds in 5- and 10-year tenors annually and 15-year bonds every three years.

The State Treasury is motivated to preserve Finland’s place in the global markets as one of the reliable and acknowledged bond issuers and thus maintain attractive debt instruments and bond issuance in the future.

Funding operations

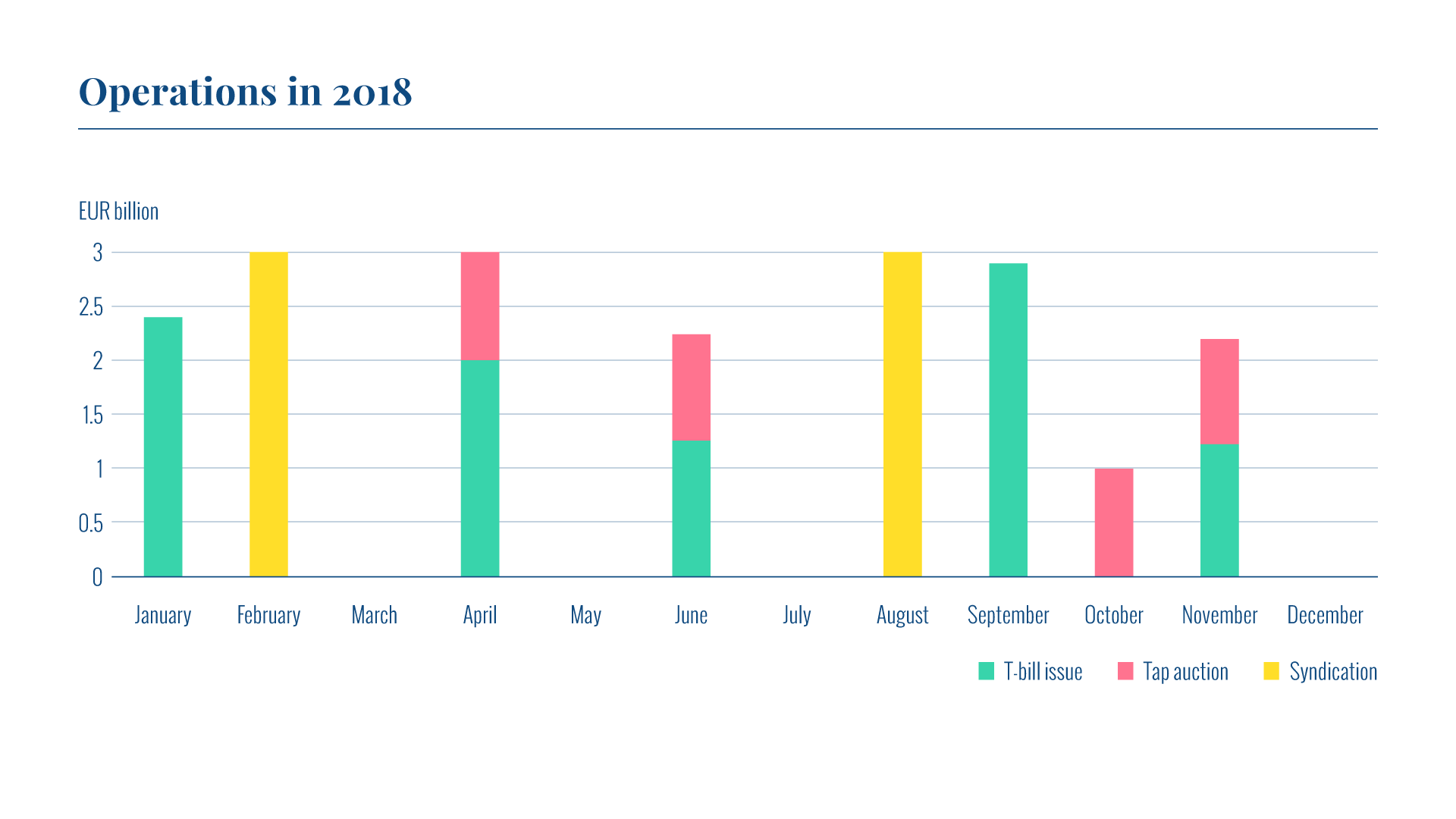

Republic of Finland issued two new euro-denominated benchmark bonds in 2018. In addition to issuing new bonds, four tap auctions were conducted. One of the auctions was a twin-line tap auction. The short-term funding was carried out via the Treasury bill programme.

Two new benchmark bonds were issued in syndications. The first bond issue in February was a new 15-year benchmark bond with a 2034 maturity, which provided a new maturity point with a current coupon on the yield curve in that segment. The issue size of the bond was EUR 3 billion, with an order book of EUR 11.4 billion and interest from more than 120 investors.

The second bond issue in late August was a new 10-year benchmark bond of EUR 3 billion. The bond was met with strong demand as the order book grew to over EUR 13 billion, with 120 investors expressing their interest in the bond.

Tap auctions

Four tap auctions on existing euro benchmark bonds were conducted during the year. The total funded volume via bond auctions was approximately EUR 4 billion.

The first auction of the year was conducted at the end of April for the benchmark bond maturing on 15 September 2027. The auction increased the outstanding stock of the bond by EUR 1 001 million to EUR 4 996 million. The bid-to-cover ratio of the auction was 1.6.

The second auction, held in mid-June, brought the outstanding volume of the newly issued benchmark bond maturing in 2034 to EUR 3 986 million. The third auction was held in October for the new 10-year benchmark bond maturing on 15 September 2028. The outstanding volume of the bond after the auction was EUR 4 000 million.

The final auction of the year, arranged in November, was a twin-line exercise with two different maturities: the benchmark bond maturing on 15 September 2023 and the serial bond maturing on 15 April 2047. The total size of the dual auction was EUR 975 million. The bid-to-cover ratios of the auction were 1.94 and 1.17, respectively. The outstanding amounts of the bonds after the auction were EUR 5 475 million for the 2023 bond and EUR 2 500 million for the 2047 bond.

Issuance in different currencies

In its funding strategy, the Republic of Finland is committed to issuing in other currencies than the euro to complement its euro-denominated borrowing and to serve a broader base of investors. Opportunities for issuance under the Euro Medium Term Note programme will be further monitored during 2019.

Short-term funding

The Republic of Finland has an active Treasury bill programme. The programme is similar to European Commercial Paper programmes. In 2018, the Treasury bills were issued in daily tapping windows, the timing of the issuance depending on the liquidity position of the central government. The daily tapping supports the optimal government liquidity management, and the T-bills are available to investors continuously in a flexible manner. T-bills are issued in two currencies: euros and US dollars. In 2019, the Republic of Finland will also start issuing euro-denominated T-bills in auction format.

The T-bill issuance window was open in 2018 during six occasions: in January, April, June, September, October and November. Most of the issued T-bills were USD-denominated. The average maturity was 4.7 months (5.5 in 2017). The gross issuance of USD-denominated T-bills was USD 11.175 billion (equivalent to EUR 9.3 billion) while that of euro-denominated T-bills was EUR 718 million. The outstanding stock at year end was USD 4,575 billion and EUR 404 million.

Liquidity management

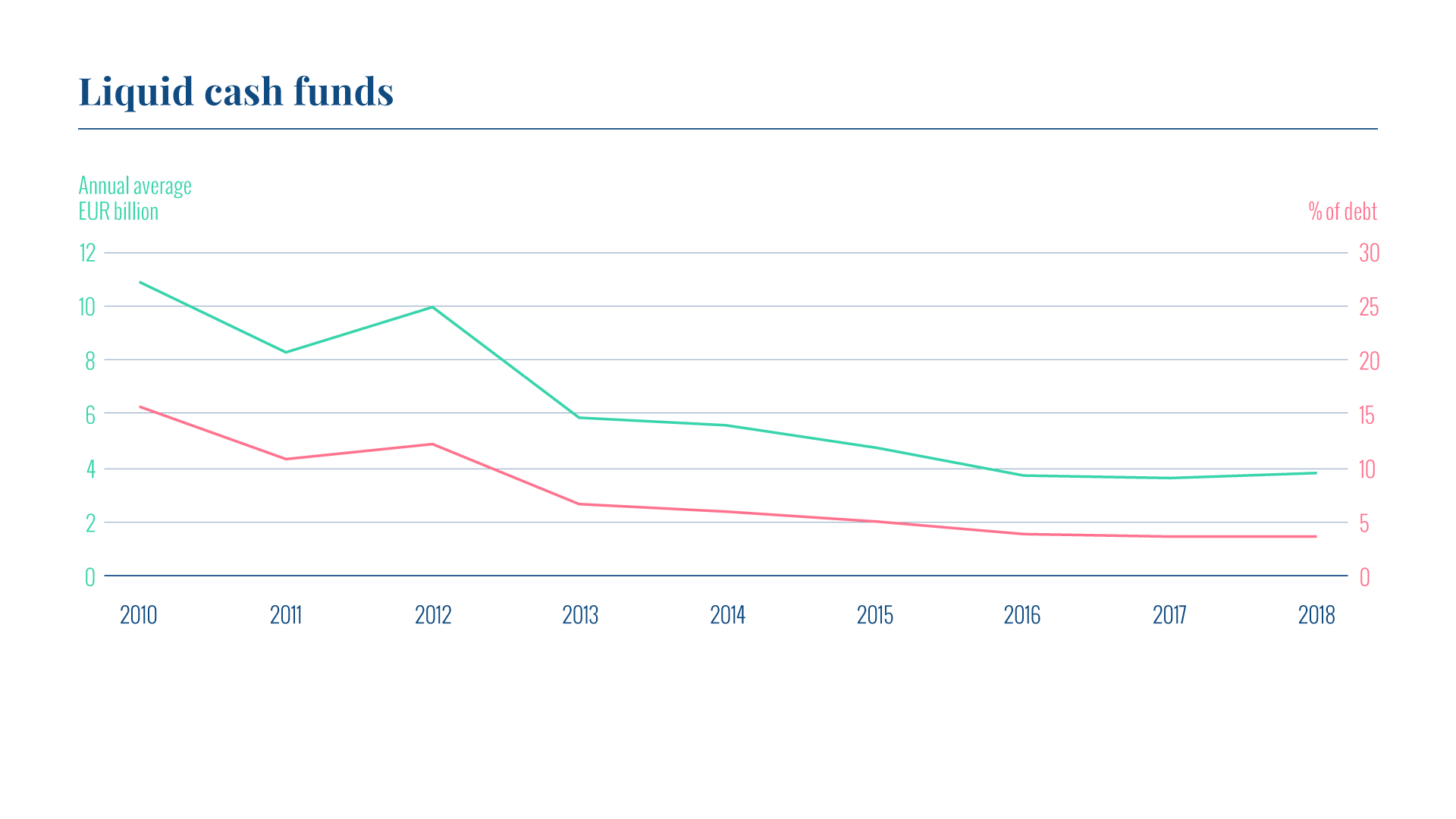

The liquidity position of the central government remained strong during the year. The amount of cash reserves is based on an assessment of sufficient liquidity and a limit on uncovered net cash flows.

The cash reserves are invested in the short-term maturities. To avoid credit risk, the investments are mainly carried out in the form of triparty repo agreements.

Liquidity management relies strongly on the cash flow forecast system. All government accounting entities forecast their income and expenditures for the next 12-month period into the system. The State Treasury is using this data as a basis for liquidity management decisions.