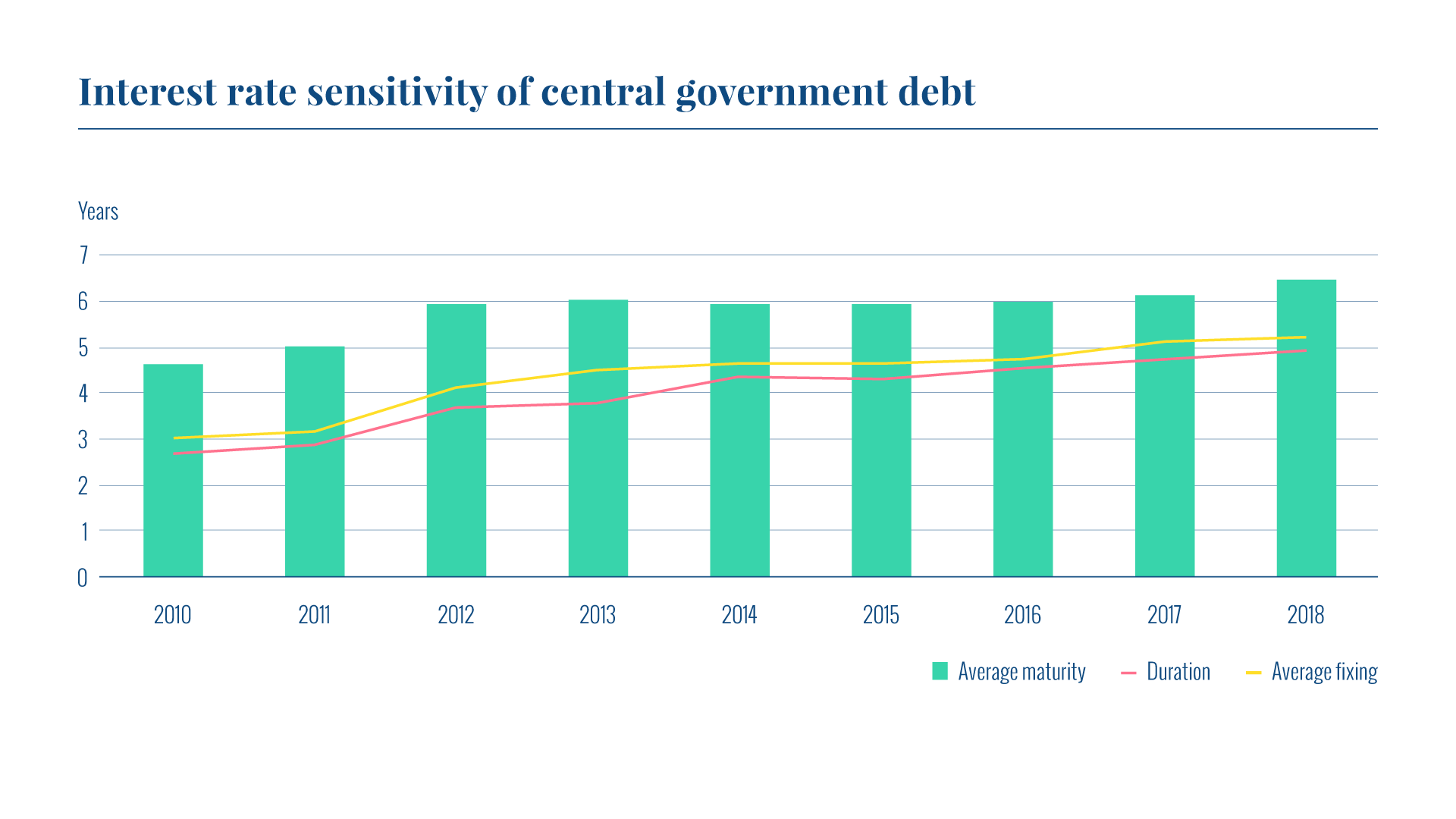

The objective of Finland’s central government debt management is to fulfil the State’s financial requirements and to keep the long-term costs of servicing the debt as low as possible in relation to risks resulting from the debt, in such a way that the risks are acceptable in terms of national risk-bearing capacity.

Debt management framework

The general principles and objectives of central government debt management are determined by the Ministry of Finance. The State Treasury is a central administrative agency operating under the Ministry of Finance and implements all debt management operations under the guidelines prepared by the Ministry.

The Ministry’s guidelines set out the general principles and objectives of debt management, instruments used in debt management and risk limits as well as other restrictions that must be observed. The State Treasury is authorised to raise funds, provided that the nominal value of the central government debt does not exceed EUR 125 billion until further notice and that, at the time of borrowing, the value of short-term debt does not exceed EUR 18 billion.

The State Treasury is authorised to take out short-term loans when necessary in order to safeguard the central government’s liquidity, as well as to enter into derivative contracts when managing the risks under conditions determined by the Ministry of Finance and under its direction.

The State Treasury reports regularly on debt management to the Ministry of Finance. The government submits financial statements to Parliament annually, including an overview of the condition of the national economy and the productivity of the Ministry of Finance’s administrative sector.